As one year ends and another begins, you have a powerful opportunity to reset, refocus, and strengthen your financial life. Whether you're looking to get out of debt, build savings, plan for retirement, or just feel confident about your money, intentional planning now can change your financial landscape all year long.

This comprehensive guide lays out practical, actionable steps to prepare your finances for 2026 — from reflection and budgeting to investments, tax planning, and long-term financial health.

1. Reflect on Your Financial Year

Before you set new goals, take time to honestly review the year that just passed. This reflection gives clarity on what worked — and where you can improve.

Ask yourself:

-

Did you hit your financial goals?

-

Where did you overspend?

-

What unexpected expenses came up?

-

How did your income change?

-

What habits helped — or hurt — your financial progress?

This isn't about judgment — it's about learning. Honest reflection helps you identify patterns, understand where adjustments are needed, and celebrate progress you may have overlooked. thebudgetmom.com

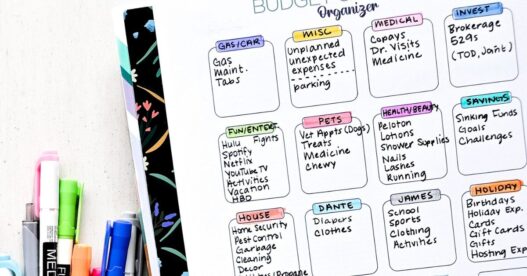

2. Audit and Optimize Your Budget

A budget isn't a rigid set of rules — it's a tool that should adapt with your life.

Steps to rework your budget:

-

Review all income sources: include side jobs, bonuses, or sporadic income.

-

Categorize your spending: separate needs (rent, utilities) from wants (dining out, entertainment).

-

Track everything: look at bank statements to catch missed categories and recurring expenses.

-

Adjust for changes: new family needs, subscription creep, or lifestyle shifts.

If a category consistently gets overspent, that's a sign to either reduce the allocation or adjust the category itself.

Tip: Tools like spreadsheets, budgeting apps, or envelope systems make tracking easier — find what works for you and stick with it.

This ongoing budget adjustment ensures your plan matches your financial reality for 2026. thebudgetmom.com

3. Plan for Annual and Irregular Expenses

Many people forget about expenses that don't happen monthly but still impact your budget — things like:

-

Insurance premiums

-

Taxes (property, self-employment)

-

Car registration and maintenance

-

Holiday and birthday gifts

-

Travel costs

-

Pet care or vet visits

Create sinking funds — dedicated savings for these known irregular expenses — by estimating annual costs and dividing them by 12. This keeps you from scrambling or borrowing when those bills pop up. thebudgetmom.com

4. Build (or Strengthen) Your Emergency Fund

A strong emergency fund provides financial security and peace of mind.

General guide:

-

Beginner (Kickoff fund): $1,000 or one month of essential expenses.

-

Goal fund: 3–6 months of living expenses.

-

For higher uncertainty: 6+ months (great for freelancers, variable income earners, or families).

Automate transfers to this fund so consistency builds your cushion without effort. As life changes, revisit your target amount — for instance, a new job situation, child, or career shift might mean increasing your goal. thebudgetmom.com

5. Revisit Your Debt Repayment Strategy

Debt slows financial progress – but it's also an area where strategy === savings.

Try one of these approaches:

-

Debt Snowball: Pay off the smallest balance first to build momentum.

-

Debt Avalanche: Tackle highest-interest debt first to save on interest.

-

Refinancing: If interest rates drop, refinancing can reduce monthly payments — but weigh closing costs vs. savings.

Compare all your interest rates and update your repayment plan for 2026. If you have multiple debts, organize them by priority and tackle them systematically. thebudgetmom.com

6. Review and Update Your Insurance Coverage

Insurance is protection you shouldn't overlook.

Key reviews:

-

Health insurance: Make sure coverage still fits your needs.

-

Auto and homeowners/renters insurance: Shop around yearly — you may find lower rates.

-

Life insurance: Revisit policy amounts if you've had major life changes (new child, marriage, home purchase).

-

Beneficiaries: Update life and disability policy contacts if life circumstances change.

Insurance isn't static — update policies to protect yourself and your family better. thebudgetmom.com

7. Automate and Simplify Your Financial Life

Automation saves you money and reduces stress.

Automate:

-

Savings: Regular, automatic transfers to emergency funds, investments, or sinking funds.

-

Bill payments: Reduces late fees and protects your credit.

Simplify:

-

Consolidate accounts to reduce confusion.

-

Cancel unused subscriptions or memberships (a hidden budget leak for many). thebudgetmom.com

8. Set Clear Financial Goals

New goals help you focus your money where it matters most.

Use the SMART framework:

-

Specific

-

Measurable

-

Achievable

-

Relevant

-

Time-bound

Examples:

-

Pay off $5,000 in credit card debt by June.

-

Save $3,000 for a vacation by year's end.

-

Increase retirement contributions by 1%.

Break big targets into monthly milestones — smaller chunks feel more achievable and keep motivation high. thebudgetmom.com

9. Maximize Retirement Contributions (2026 Limits)

Your retirement savings should grow with your goals.

2026 retirement contribution updates:

-

401(k) contribution limit increased to $24,500.

-

Catch-up contributions for ages 50+ remain $8,000, and higher limits ($11,250) apply for ages 60–63 under SECURE 2.0 rules.

-

IRA limit increases to $7,500. IRS

Actions to take:

-

Maximize employer retirement matches — it's free money.

-

If you're eligible, open or contribute to a Roth IRA for tax-free growth.

-

Review your investment allocations annually.

Even small increases in contributions now can have significant long-term impact.

10. Organize for Tax Season (2025 Returns Due in 2026)

Tax planning shouldn't wait until April.

Now is a great time to:

-

Organize 2025 receipts and deductions.

-

Check whether your withholding needs adjustment (especially if you changed jobs). Northwestern Mutual

-

Consider strategies like timing deductions or Roth conversions.

Recent legislative changes also introduced new deductions for seniors (e.g., a temporary $6,000 senior deduction for 2025–2028) that might impact your return. The Sun

Getting ahead of taxes now can reduce stress and potential liabilities when tax season starts.

11. Plan for Major Life Milestones

Think about significant goals in 2026:

-

Buying a home

-

Expanding your family

-

Career changes

-

Starting a business

Financial plans should reflect these life changes — update goals and budgets accordingly. Partnering with a financial advisor can add clarity and tailor a strategic plan for these milestones. Northwestern Mutual

12. Strengthen Your Investment Strategy

Investing isn't just for retirement. Building wealth requires intentional strategy.

Considerations for 2026:

-

Rebalance your portfolio to maintain risk tolerance.

-

Diversify across asset classes (stocks, bonds, real estate, etc.).

-

Stay mindful of investment fees and tax efficiency.

If you're unsure or need support, a financial advisor or robo-advisor can provide a personalized investment approach based on your goals.

13. Check and Improve Your Credit Health

Your credit score affects loan interest rates, insurance premiums, and even job prospects.

Credit checklist:

-

Pull your free annual credit report.

-

Review for errors and dispute inaccuracies.

-

Lower credit utilization by paying down balances.

-

Keep old accounts open to improve credit history.

Good credit enhances financial opportunities and should be part of your annual maintenance plan.

14. Don't Neglect Your Estate Plan

Estate planning isn't just for the wealthy — it's about protecting your loved ones.

Important documents:

Review these if life changes occurred — marriage, children, or a major move. Estate planning reduces stress for your family and ensures your wishes are honored.

15. Prepare for Cash Flow and Liquidity Needs

Cash flow matters. Make sure your accounts are positioned so you can:

-

Cover monthly bills comfortably

-

Maintain emergency liquidity

-

Handle irregular expenses without stress

If cash flow feels tight, revisit your budget and adjust discretionary spending or automate savings differently.

16. Educate Yourself and Seek Trusted Support

Financial literacy pays dividends.

Ways to grow your knowledge:

-

Books, podcasts, and courses focused on money management.

-

Free community or online financial workshops.

-

Consultation with certified financial planners.

17. Build Resilience Against Economic Changes

The economic environment — including interest rates, inflation, and job market dynamics — can shift quickly. Staying informed allows you to:

-

Optimize savings and investment decisions

-

Adjust priorities proactively

-

Take advantage of opportunities (e.g., higher interest savings accounts or refinancing when rates drop)

Financial resilience means planning for uncertainty as well as opportunity.

The transition into a new year isn't just symbolic — it's a strategic window to strengthen your financial foundation. Whether this year you focus on budgeting, debt repayment, retirement growth, tax planning, or long-term goals, the steps you take now set the stage for financial confidence and growth.

Remember: financial preparation doesn't require perfection — it requires consistency, reflection, and action.

Here's to making 2026 your most financially empowered year yet!