Saving money regularly is one of the simplest ways to build financial security. A Recurring Deposit (RD) is a popular option for people who want to save small amounts every month and earn guaranteed returns. But before starting an RD, it's helpful to know how much you'll accumulate at the end of the term. That's where an RD calculator becomes a useful tool.

Let's see how it helps you plan your future savings more effectively.

What Is an RD?

An RD or Recurring Deposit is a scheme provided by post offices and banks. You pay a fixed sum of money each month over a period of time, say 6 months, 1 year, or 10 years. You receive your entire deposit back with interest at the end of the term.

It's a safe and disciplined method to save because:

- You invest in saving every month.

- The interest rate is predetermined at the beginning.

- You're sure of what you will get on maturity.

Why Use an RD Calculator?

Although you can calculate the maturity value by yourself, it's easier to use an RD calculator. It assists you:

- To easily estimate how much you'll save in the long run.

- To compare various deposit amounts and tenures.

- Know how the interest rate influences your ultimate savings.

This facilitates planning for your future targets, such as education expenses, a family vacation, or emergency savings.

How Does an RD Calculator Work?

RD calculator is a quick online computer program. All you have to input:

- Monthly deposit amount – The amount that you intend to save monthly.

- Tenure – The overall duration of your RD, such as 24 or 60 months.

- Interest rate – Your bank or post office rate.

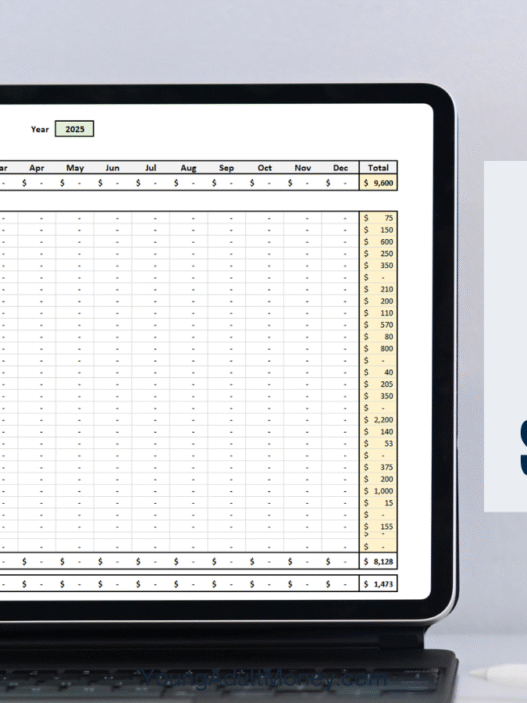

After you input these numbers, the calculator immediately displays:

- Total deposited amount (your savings).

- Total interest.

- Maturity value (deposits plus interest).

It saves you time and prevents calculation mistakes.

Rather than guessing, the calculator provides a precise number in seconds, which makes it simpler to determine whether this plan is right for you.

Benefits of Using an RD Calculator

Improved Goal Planning

With a clear idea of how much you'll be saving, you can correlate it to your future requirements, such as children's school fees, purchasing a gadget, or a holiday trip.

Helps Choose the Right Tenure

By experimenting with durations in the calculator, you will be able to determine which tenure provides the most optimal mix between savings and flexibility.

Compare Various Banks

Various banks provide slightly varying RD interest rates. The calculator will allow you to compare how much extra you will make by opting for a higher rate.

Promotes Disciplined Saving

Having the precise maturity value in front of you can encourage you to remain regular with your monthly payments.

RD Tips for Maximising Savings

- Begin early in order to utilise compounding.

- Select a tenure as per your target, such as 12 months for small short-term objectives or 5 years for larger objectives.

- Compare bank rates to earn the highest return.

- Do not break your RD prematurely, as it wastes the interest earned.

RD vs Other Savings Options

Whereas an RD is risk-free and certain, it's ideal for conservative investors. If you desire potentially better returns and are willing to take a bit of risk, mutual funds or SIPs might be for you. But if you want guaranteed returns and fixed savings discipline, RD is still a good option.

Final Thoughts

An RD calculator is a powerful yet easy-to-use tool to plan your future savings. It will enable you to calculate exactly how much money you will have at the end of your deposit term so that you can plan realistic financial goals accordingly.

Whether saving for the immediate future or the distant future, an RD calculator before initiating your RD sets you in the correct direction. It only takes a few minutes but provides you with a sense of clarity and confidence regarding your savings process.

The post How to Use an RD Calculator for Future Savings Planning appeared first on MoneyMiniBlog.