Black Friday has dramatically changed over the last decade. What used to be a single chaotic morning of shoppers lining up outside stores is now an extended season of early promotions, online deals, nonstop countdown timers, and sales that start earlier every year. Retailers are competing for attention long before Thanksgiving even arrives, and the pressure to spend is higher than ever.

But even with these changes, one truth remains: Black Friday will never guarantee savings just because the price tag says it is a deal. Saving money during this season requires planning, intention, and boundaries. That is why my approach today looks nothing like the way I shopped when I was younger and trying to stretch every dollar across the holidays.

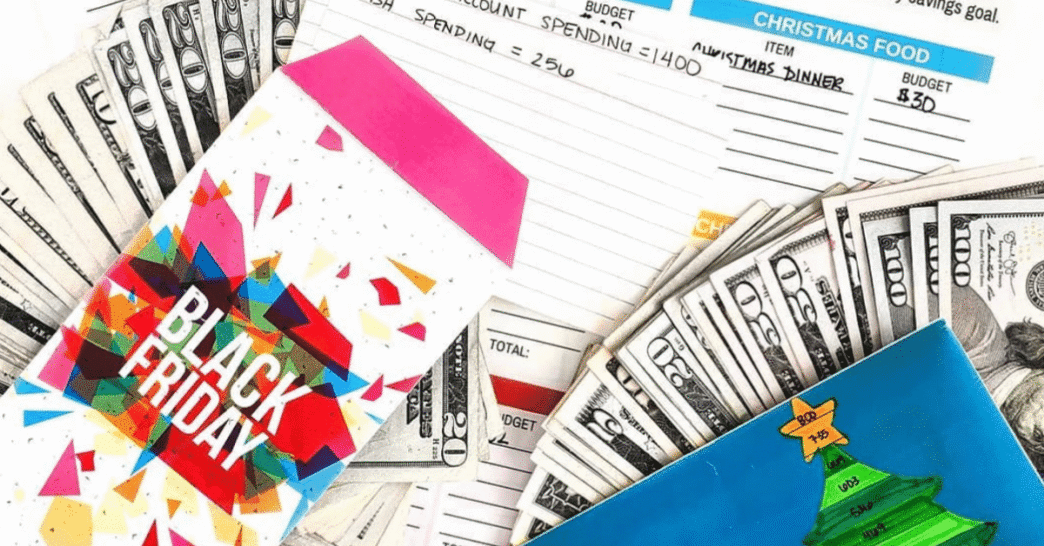

Now I rely on my Budget by Paycheck Method, sinking funds, and a clear spending plan to navigate one of the most heavily marketed shopping seasons of the year. These principles help me stay grounded and remind me that deals only matter if they support my values and stay within the amount I have intentionally set aside. A discount means nothing if it pulls me off track financially.

Whether your holiday budget is tight or you are in a more flexible season of life, this guide will help you understand how to prepare, how to avoid the psychological traps retailers rely on, and how to protect your money while still finding the real deals that genuinely support your list and your goals.

Here are the seven most important strategies to save money while Black Friday shopping this year.

1. Create a Budget the Budget by Paycheck Way

A successful Black Friday begins before you look at a single ad or visit a single website. Your first step is always your budget, but I am talking about a real budget that reflects how you actually spend money throughout the month, not just a basic list of what you owe.

Before Black Friday arrives, close out your most recent paycheck and identify exactly what is left over after covering your essential bills, fixed expenses, sinking funds, variable spending categories, and holiday savings. This is where people often get off track. They see Black Friday as permission to dip into money that was never meant for holiday spending. But you cannot steal from your rent envelope or your emergency savings or your January grocery budget and still call it saving money.

Your holiday spending number should come from:

-

Your holiday sinking fund

-

Any surplus left over after all essential categories are funded

-

The amount you intentionally assign to gifts, decor, and seasonal items in your BBP plan

When your spending money is pre-assigned in your envelopes or digital categories, you have built-in boundaries. You know what is available, and you know what is not. This eliminates the “I will just figure it out later” cycle that often leads to holiday debt.

The biggest mistake people make during Black Friday is believing the deals are the reason they should increase their budget. You create the budget first, and the deals must fit inside it. Not the other way around.

2. Build a Clear Shopping List and Stick to It

If something is not on your list, you are not saving money by buying it. You are spending money you never intended to spend. This has been a guiding principle in my own financial journey, and every single year it proves itself to be the most effective tool for avoiding regretful purchases during Black Friday.

Your list should be fully crafted before the sales begin. That means thinking through who you are buying for, what they truly want or need, and what price range feels comfortable for each person. If you use a holiday sinking fund throughout the year, this step becomes surprisingly easy. You know the limits. You know which gifts matter. And you know that the amount you set aside is the amount you have to work with.

Companies rely heavily on impulse buying during Black Friday. Research shows that the average consumer adds multiple unplanned items to their cart simply because they see the word “sale” or fear a deal will disappear. But when you start with a solid list, you shift your mindset. You are no longer asking, “Is this a good deal?” but instead asking, “Is this a good deal for me and does it belong on my list?”

A list turns off the noise. It protects your wallet from the manufactured excitement that Black Friday is known for. When you know exactly what you are shopping for, you are less likely to get lost in “deal feeds” or recommendation posts or last-minute add-ons that retailers intentionally place near checkout pages.

A list keeps your spending intentional. And intentional spending will always save more money than the best-marketed sale.

3. Understand Retail Marketing Tactics So You Do Not Fall for Them

Companies spend millions crafting the perfect Black Friday strategy that increases your chances of buying more. Once you understand these tactics, you will never look at holiday sales the same way again.

Here are the strongest marketing tools retailers use and how they influence your spending behaviors:

Countdown Timers

Countdowns trigger urgency. They make you feel like the window is closing, even if the same deal reappears tomorrow. They encourage rushed decisions rather than intentional ones.

Inflated Original Prices

Many retailers raise prices in early November so the Black Friday discount looks larger. A “60 percent off” deal might actually be the same price it was a month ago.

Scarcity Messages

Messages like “only three left” or “selling fast” are designed to tap into your fear of missing out. Sometimes these are real notices, but often they are automated triggers used to pressure you into purchasing before you think it through.

Deal Bundles and Buy More Promotions

When a retailer asks you to buy more to “save more,” the goal is simple. They want your cart value to increase. You were only planning on one item but then you are suddenly considering buying three because the discount looks tempting.

Personalized Ads and Retargeting

Everything you click is tracked. If you pause on an item for more than a second, expect to see it repeatedly. Companies know that familiarity breeds desire. The more you see an item, the more your brain believes you need it.

Triggering Emotional Responses

Retailers design ads to tap into your identity as a parent, a partner, or someone who wants to give meaningful gifts. They know you want the people you love to feel appreciated. They position items as the answer to that desire.

None of this is accidental. There are teams of people whose only job is to understand human psychology and create strategies that increase sales during this season. This is why a list, a budget, and predefined boundaries matter. You cannot rely on willpower when entire industries are working to break it.

Understanding these tactics allows you to pause, breathe, and ask yourself whether this purchase is truly aligned with your holiday plan or simply the result of emotional retail pressure.

4. Compare Prices the Right Way and Time Your Purchases Strategically

Not every deal is a deal, and Black Friday is famous for misleading pricing. If you want to actually save money, comparison is essential.

Start by researching the regular price of the items on your list well before the sales begin. Take note of any seasonal fluctuations or average price ranges. This gives you a baseline that helps you separate real discounts from inflated ones.

Price tracking tools can also help you see historical trends, especially for electronics or big-ticket purchases. When you notice a price drop that aligns with your budget and your list, that is when you make your move.

Timing matters as well. Some of the biggest discounts happen before Black Friday. Others land the week after. Companies have started spreading out promotions to encourage early spending and reduce website traffic spikes. This extended timeline works in your favor if you shop thoughtfully.

If you have a high priority item, monitor it daily during November. If it hits your target price range, do not wait out of fear that you might get a slightly better discount later. Waiting too long can lead to selling out, restocking delays, or prices that bounce back up.

Strategic timing prevents panic purchases and keeps your spending calm, grounded, and intentional.

5. Use Cash Back, Rewards, and Perks Without Letting Them Influence Your Spending

Reward programs and cash back sites can absolutely help you stretch your holiday budget further, but only if you use them with boundaries.

These tools should enhance your savings, not drive your spending decisions. The moment an app or a points program convinces you to buy something you did not plan to buy, it stops being helpful.

Many stores offer additional incentives during Black Friday such as extra points, members only discounts, or exclusive early access. If these promotions align with your plan and your list, take advantage. But if the promotion is encouraging you to add more items or increase your cart value simply to earn more points, that is where you pause.

Your Budget by Paycheck envelopes for holiday spending should guide the decisions, not the reward program. When you use sinking funds and BBP categories, you already know how much you have available. You cannot accidentally overspend when your categories are funded and your boundaries are clear.

If you choose to use a credit card for rewards, make sure it is a card you already use responsibly. This means paying it off in full every single month and not adding purchases for the sake of earning cash back. Rewards are only a benefit when you remain disciplined.

When used intentionally, these perks lower your overall cost. When used impulsively, they become a trap.

6. Prepare Early by Setting Up Your Holiday Systems Before the Sales Start

Black Friday should never feel like a surprise. Some of the most effective ways to save happen long before the first sale is announced.

Start by reviewing your holiday sinking fund. Ask yourself whether the amount you have set aside aligns with your list for this year. If it does, wonderful. If it does not, adjust your upcoming Budget by Paycheck allocations to match your goals.

Next, update your holiday calendar. Factor in travel costs, events, hosting responsibilities, and last minute expenses that always show up around this time of year. The more you plan early, the less likely you are to become overwhelmed by unexpected costs later.

Another key part of preparation is setting up your tracking systems. Close out your current monthly budget. Start your next tracking period early. Review your envelopes and reset any categories that need attention.

This allows you to enter the holiday shopping season with clarity. You know exactly where you stand financially, and you know exactly what you can spend without derailing your December bills or your January stability.

When you prepare early, you reduce the mental load and increase your chances of making intentional choices rather than reacting to holiday pressure.

7. Protect Your Values as Much as You Protect Your Wallet

Saving money on Black Friday is not only about the numbers. It is about staying aligned with the type of holiday season you want to create.

Retailers want you to believe that a large pile of gifts equals a successful holiday. They want you to believe that your worth as a parent or partner is reflected in how many boxes end up under the tree. But your values tell a different story.

When I look back on the holidays I had growing up and the holidays I have created with my boys, the memories that matter most are not the things we bought. They were the small traditions, the moments of connection, and the experiences that made us feel close.

That is why your financial choices during Black Friday need to reflect the holiday experience you want to build, not the commercial one you are pressured to participate in.

Ask yourself:

-

Does this purchase add meaning to our holiday or just clutter

-

Am I buying this because it is on sale or because it truly belongs on my list

-

Is this gift aligned with the values I want to teach my kids

-

Will this purchase bring joy in January or just stress when the credit card statement arrives

Protecting your values ensures you enter the holiday season proud of your decisions instead of overwhelmed by them. Black Friday should support your financial wellbeing, not undermine it.

Bottom Line

Black Friday is designed to push you into emotional, impulsive, and rushed decisions. But with the right preparation, a clear list, and a budget rooted in intention, it becomes an opportunity instead of a trap.

Saving money during this season is not about chasing every flashy discount. It is about using the tools that actually lead to financial confidence: your Budget by Paycheck Method, your sinking funds, your spending categories, and the values that guide every decision you make.

Black Friday savings only matter if they support your plan.

A deal only matters if it belongs on your list.

The holidays only feel good when you stay true to what you value.

With the right foundation in place, you can shop confidently, protect your money, and create a holiday season that feels joyful, intentional, and fully aligned with the way you want to live.