Every few months or so, my husband suggests “I” have a new baby. He carefully uses the word “we” when framing his request, but we both know it's my autonomy and my career that are at stake.

We're already playing financial gymnastics with two young children at home, a long game at extreme odds with my husband's dreams of early retirement and my steadfast resolve to help our kids have a less painful launch into adulthood than my own.

Kids cost so much money that I almost understand the appeal of being a DINK.

Back in the 1980s, the term DINK, an acronym for dual income, no kids, became shorthand for couples living the good life. Two professional paychecks, zero daycare bills, and all the freedom to travel, dine out, and live life large.

Most of us, however, choose to have offspring, and are willing to sink some of our adult-life ambitions to achieve that goal.

Thus, my husband and I have an “heir and a spare” at home: someone for the other child to bicker and play with, and an added caretaker in our old age.

How Far Do Kids Push Out Retirement?

My husband and I may have to work a good portion of our “golden” years. Kids definitely push out retirement, but by how far? And what does the math look like for those with no kids, or just one?

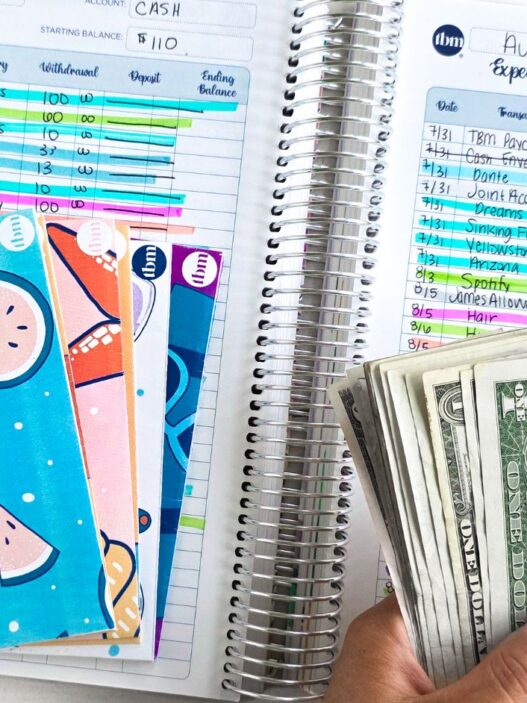

I ran the numbers across different scenarios. For a DINK couple earning $800,000 a year (a hypothetically plucked figure; I'm sure that you're much more financially successful), one child could push out retirement by seven years while two kids add 15 years or more to the horizon.

Why Even High Earners Struggle to Retire Early

For high-earning households, an early and opulent retirement should be a given. They're living a life of ease compared to most Americans who are struggling, with 1 in 4 using BNPL (Buy Now, Pay Later) services to finance their groceries.

But retirement still remains a challenge for wealthy households too, especially those in high-cost-of-living areas.

Here's why:

- Taxes take a bigger bite. High earners can lose 30% to 40% of their gross pay to federal, state, and local taxes (IRS, Intuit TurboTax).

- Student loans can linger for a decade. The average medical school debt, excluding undergraduate loans, is $234,597.

- Lifestyle creep is real. A bigger home, fancier travel, networking dinners, and private school tuition are silent killers.

- Medical and childcare costs add up. Out-of-pocket medical expenses for a family can hit five figures annually, and childcare can rival a second mortgage.

| Category | Single High Earner $500K | DINK Couple $800K | DINK Couple + 1 Kid | DINK Couple + 2 Kids |

| Gross Annual Income | $500,000 | $800,000 | $800,000 | $800,000 |

| 401(k)/403(b) and HSA | $29,050 | $58,100 | $58,100 | $58,100 |

| Federal and State Taxes | $165,000 | $264,000 | $264,000 | $264,000 |

| Student Loans (10 yarrs) | $27,000 | $27,000 | $27,000 | $27,000 |

| Mortgage | $63,000 | $63,000 | $63,000 | $63,000 |

| Property Taxes, and Insurance | $15,000 | $15,000 | $15,000 | $15,000 |

| Cars (payment, insurance, gas) | $12,000 | $20,000 | $22,000 | $24,000 |

| Medical Out-of-Pocket | $4,000 | $8,000 | $10,000 | $12,000 |

| Groceries | $12,000 | $18,000 | $24,000 | $30,000 |

| Eating Out | $9,000 | $14,000 | $15,000 | $16,000 |

| Entertainment/Local Outings | $6,000 | $9,000 | $10,000 | $11,000 |

| Vacations/Travel | $20,000 | $35,000 | $39,000 | $43,000 |

| Grooming/Clothing/Household Shopping | $5,000 | $9,000 | $11,000 | $13,000 |

| Childcare (0–11) | — | — | $24,000 | $48,000 |

| Activities/Tutoring (12–18) | — | — | $12,000 | $24,000 |

| College Savings | — | — | $6,000 | $12,000 |

| Private K–12 Tuition | — | — | $27,000 | $54,000 |

| College Out-of-Pocket Average | — | — | $15,000 | $30,000 |

| Hidden Lifestyle Drags | $10,000 | $16,000 | $18,000 | $20,000 |

| Total Annual Expenses | $367,050 | $556,100 | $646,100 | $784,000 |

| Annual Surplus | $132,950 | $243,900 | $153,900 | $16,000 |

| Retirement Age (8% return, 5% drawdown) | 53 | 50 | 57 | 65+ |

Disclaimer: Assumes both earners max out 401(k)/403(b) and HSA contributions each year, receive a 2% real wage increase annually, and earn an average 8% annual return on invested surplus. Student loans at $208K total, 5.3% interest, 10-year payoff. $1.1M home with 4% mortgage. Lifestyle costs reflect high cost-of-living metro averages, including private school tuition in the top 15 highest COLAs in the U.S., luxury travel, and premium goods/services. Taxes estimated for high earners in high-tax states. Retirement ages based on maintaining a high standard of living with 5% annual drawdown.

You're mentally tearing these calculations to smithereens. And you should. Your figures and your scenario will look wildly different, but these hypotheticals are here to provide a directional read and the abiding truth still remains: kids require financial sacrifice.

There are great calculators out there for you to play around with, baking in other obligations like fertility treatments, supporting elderly parents, orthodontics, house cleaning services, pets, and the cost of adding adolescents to your auto policy.

The Financial Edge of Stopping at One

For any household, having two or more children shifts entire financial trajectories. But if you love the DINK lifestyle and still want to be a parent, stopping at one may be a solid compromise. Jumping from zero to one kid increases expenses, but not in a way that will quash your early retirement dreams.

Part of the reason is economies of scale. Housing and utility costs barely change. The same car can haul one kid as easily as none. Even travel, while pricier, doesn't double. And in many metro areas, one child means you can still avoid upsizing into a larger home.

Andréa Tinoco, a project manager at Physician on FIRE, explains the benefits and freedom of being married with just one kid.

“We live in a townhouse in a great neighborhood in Houston with really good public schools, so we won't have to pay for private tuition,” says Andréa. With another child, they'd likely need a bigger house in the suburbs, much less desirable to them, or stay in the city and take on a bigger mortgage.

She says, “With just one kid, my husband and I can still do everything we did as a couple.” Logistically, it's easy to bring their daughter along to adult spaces, like nicer restaurants or music festivals because there are two grown-ups to look after one child.

Two Parents to One Kid Is a Great Ratio

“Our daughter goes where we go,” Andréa says, which limits childcare and babysitting costs. “When we travel by plane, she can still sit on our lap, so it doesn't cost extra for her to fly anywhere with us.”

However, the shift from one to two children is different. Costs compound astronomically.

- Childcare doubles or more. (Childcare center tuition goes up every year, so any sibling discount is a wash.)

- Private school tuition and college savings double outright.

- Activities and tutoring, which are often essential for competitive academic environments, can more than double.

- Transportation costs rise as logistics get more complex: sports, music lessons, multiple school drop-offs.

- Income may drop. With family leave, parents lose time advancing their careers. And if one parent drops out of the workforce, household income drops significantly.

For high earners in competitive metros, these lifestyle drags are vicious. DINK couples severely underestimate how much their flexibility and discretionary spending power come from not having children.

The Emotional Side of the Decision

The FIRE movement's prescriptive advice of “spending less, investing more” so you can retire early collides head-on with parenting, but it's hard to let cold math shape something so personal.

On a Reddit FIRE thread, many doctors and high earners admit to making peace with stopping with one child (or none) after seeing the trade-off between time, money, and emotional bandwidth.

One Redditor sums it up in the top response: “You spend less without kids, so you can save more…so you need a smaller number to retire.”

This also provides more investment flexibility when you have “only yourself and maybe one other person to worry about, so you can have a more aggressive withdrawal rate and adjust spending based on market returns.”

Another Redditor chimes in, “I am very happy and so is my [significant other] with our decision to be child free. Our decision is consistently validated compared to our peers and friends with children in pursuit of FIRE.”

One-Child Couples as the New DINKs

As our hypothetical charts point out and Andréa has shown, being a DINK with one could be the sweet spot.

With one child, you experience parenthood, early retirement is still largely possible, and you don't have to (materially) downgrade your DINK lifestyle. Additionally, you don't have to field questions about when you're having children or why you don't have any, although strangers may cajole you to “just have another one” as your child “deserves a sibling.”

And being an only child, the byproduct of all parental resources and attention, may benefit your family in other ways. Research finds that only children often excel in achievement — higher academic performance, more education, more accolades and recognition — than those with one or more siblings. Additionally, only children are often more creative.

But these gains come with tradeoffs. Some studies show that only children score slightly lower in sociability than their peers, but not all research supports this. Other studies show that only children fare just as well socially, and journalist Lauren Sandler's research has found that only children may have an emotional edge.

As an only child herself, Sandler says, “We have the strongest primary relationship with ourselves, which is incredible armor against loneliness.” For only children, they learn “the experience of solitude, which is a very rich thing” while those with siblings can find being alone “painful” and isolating.

The Takeaway: Your Lifestyle, Your Timeline

If you're in the DINK or DINK-with-one-child camp, you are playing a totally different financial game. Having two or more kids can delay retirement by decades, not to mention the added stressors and demands on your time.

It's all about trade-offs. You can keep advancing your career and earnings while raising multiple kids, and retire early — but with each child, that date stretches further out. With no kids or one kid, you're looking at shorter working life.

The Financial Samurai, Sam Dogen, retired in 2012 at age 34 with $3 million saved. Dogen shares his blunt take in his article, ”Not Having Kids Is Your FIRE Super Power: Don't Blow It!”

Dogen reentered the workforce in 2020, after his wife gave birth to their two children in 2017 and 2019. He now calls retiring early, with kids, “nearly an impossible task.”

It's your life, your priorities, and your timeline. But if your goal is FIRE above all else, you don't have to forsake parenthood. As the raw math suggests, and Andréa's experience has shown, you can still be a DINK with one.