One of the most valuable things that money can buy us is a sense of security. Most of us do our best to determine how much we'll need in retirement to feel that security. But the additional unknown of knowing whether you might have enough for some life-altering experience, such as a medical emergency, is hard to predict. You can do a few things to financially protect yourself and your loved ones. One of these protective measures is life insurance and the other? Critical illness insurance.

What is Critical Illness Insurance?

This type of insurance is a form of coverage to cover unexpected medical costs that impact your livelihood and ability to work. For instance, if you end up with a cancer diagnosis or suffer a stroke — having this type of insurance would protect you financially.

Although we have public healthcare in Canada, you'll often pay for some expenses out of pocket. And those expenses can be overwhelming, particularly if you face loss of income or an income reduction. Critical illness insurance will provide a lump sum payment so that you can continue to pay your bills and essential expenses while also providing for family members that may need your financial support.

After all, no one wants to deal with the added stress and overwhelm that comes with an unexpected and life-altering medical diagnosis.

Who Needs Critical Illness Insurance?

This type of insurance can be extremely important if you don't have access to a significant emergency fund that would be able to cover your inability to work due to a medical situation.

You may be thinking, how likely will I end up using this policy? The reality is: probably more likely than you think. According to the Canadian Cancer Society, 40% of Canadians will experience cancer in their lifetime. Another 90% of Canadians are at risk for a heart condition, stroke, or vascular disorder. For this reason, it's not unrealistic to arm yourself with the right amount of critical illness insurance.

Why I'm Considering Critical Illness Insurance

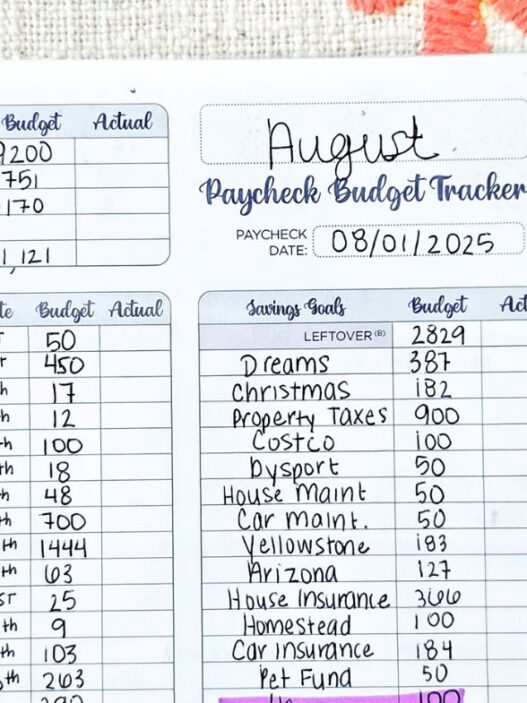

When it comes to the unexpected, my mindset has always been to overprepare. I have three emergency funds and am always considering whether my retirement plans are solid. In the past, I've found I'm sometimes over-saving in my bank accounts rather than finding financial products that protect me for a reasonable cost. Critical illness insurance is one of these products.

Before I pull the trigger on any new monthly payment that will impact the bottom line of my budget, I must ensure I'm not paying for more than I need. So, I checked to see what my critical illness insurance coverage was through my full-time employer. As it turns out, I have none.

How Much Is Critical Illness Insurance?

Before you go Googling critical illness insurance and opt for the first link, it's super important to do some comparisons. After researching, I found that the cost could range based on a few factors, including age, health, gender and the plan you choose.

To check whether the cost of critical illness was worth it for our family, I got a quote from my favourite life insurance provider, PolicyMe. The total cost for my husband and I to receive coverage for 44 potential illnesses, the most coverage in Canada, were under $50/month. That is a manageable cost considering the financial burden it could prevent in the future. After comparing a few other providers, this is far beyond the best price we could find. This price, of course, will depend on your personal needs.

How Do You Sign Up?

If, after reading this post, you feel like critical illness insurance is something that would benefit you or your family, the first thing you can do is get a quote from PolicyMe to determine how much it could cost you to receive coverage, how much coverage you need, and whether you're eligible.

These days, you don't have to go through the agony of walking into an insurance company and feeling like you have to expose every part of your health history to get an estimate on cost. Instead, you can check out what you need and what you'll pay with a few clicks and a few minutes of time.

When it comes to financial security, there isn't much I wouldn't pay for peace of mind and protection in moments of difficulty. Critical illness insurance is a cost that makes me feel like I'm covered by the unexpected.