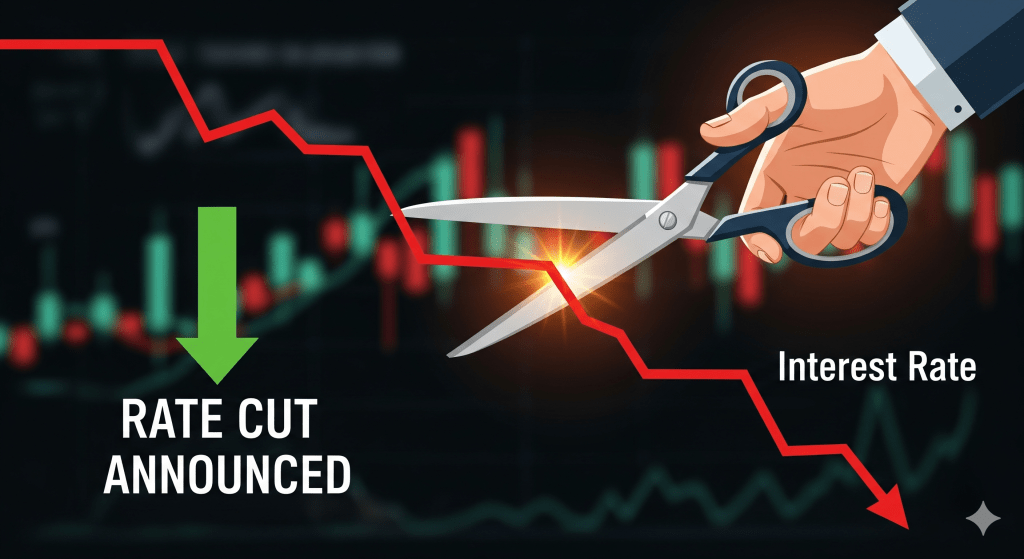

The U.S. Federal Reserve has made its first interest rate cut of 2025, lowering the federal funds rate by 0.25 percentage points to a new target range of 4.00%–4.25%. The decision, announced on September 17, 2025, comes amid slowing job growth, moderating economic activity, and persistent inflation concerns. This move could mark the start of a broader easing cycle designed to support economic growth and stabilize the labor market.

(Reuters)

Key Discussions:

1. Slower Job Growth and Labor Market Strain

Recent economic data shows that job growth has slowed, and unemployment has ticked up slightly. While the labor market remains relatively strong, certain groups — especially younger workers and those new to the workforce — are seeing increased pressure.

Fed Chair Jerome Powell highlighted that risks to employment have “risen,” signaling that the Fed is becoming more focused on protecting jobs.

(Reuters)

2. Inflation Remains Elevated

While inflation has cooled from its peak, it remains above the Fed's 2% target. Core inflation, which excludes food and energy, continues to show stubbornly high levels, leaving policymakers cautious about cutting too aggressively.

(AP News)

3. Economic Growth Moderating

The Fed noted that economic activity has “moderated” in the first half of 2025, driven by slower consumer spending and reduced business investment.

This moderation, combined with labor market weakness, added pressure on policymakers to act.

(Federal Reserve Statement)

What the Fed Did — and Signaled for the Future

-

New Rate Range: The federal funds rate now sits at 4.00%–4.25%, down from 4.25%–4.50%.

(CBS News) -

Future Cuts Expected: Fed projections suggest two more cuts are likely before the end of 2025, likely during the October and December meetings, if conditions continue to weaken.

(Reuters) -

Internal Dissent: Not all Fed members agreed. Stephen Miran, a newly appointed policymaker, dissented, arguing for a 0.50 percentage point cut to provide faster support to the economy.

(Reuters) -

Balanced Risks: The Fed emphasized that risks are now more evenly balanced between inflation and employment, signaling a shift in priorities.

(Federal Reserve Statement)

What This Means for Consumers and Businesses

Borrowers: Lower Costs Ahead

As rates drop, mortgage rates, auto loans, and business financing costs are expected to decrease gradually. This should make it cheaper for consumers and businesses to borrow, though changes may not be immediate.

(AP News)

Savers: Lower Returns

On the other hand, savings account yields, CDs, and other fixed-income products are likely to offer lower returns as rates decline, which could affect retirees and those relying on interest income.

(AP News)

Businesses: Potential Growth Boost

Lower borrowing costs encourage business expansion, hiring, and investment. However, companies will remain cautious due to ongoing inflationary pressures and global uncertainties.

(Reuters)

Risks and Uncertainties Ahead

-

Persistent Inflation: If inflation fails to decline further, the Fed may pause or reverse cuts to keep prices in check.

(Reuters) -

Labor Market Weakness: A sharper downturn in jobs could push the Fed to make larger or more frequent cuts.

-

Global Factors: Trade disputes, energy price shocks, and supply chain disruptions could unexpectedly affect the Fed's strategy.

What to Watch Next

-

Inflation Reports: Key data such as CPI and PCE will guide the Fed's next moves.

-

Jobs Data: Employment growth, wages, and unemployment rates will be crucial indicators.

-

Fed Communications: Upcoming speeches and minutes will reveal whether the Fed leans toward more aggressive easing.

-

Market Reactions: Bond yields, futures, and stock movements will reflect investor expectations.