Ever feel like your budget just isn't working anymore? Maybe you're overspending in certain areas, struggling to stick to your categories, or just losing motivation to keep up with tracking your money.

When this happens, most people make one of two mistakes:

- They scrap their entire budget and start from zero (which is overwhelming).

- They give up completely, assuming budgeting just isn't for them.

But there's a better way—a soft budget reset.

A soft reset means making small, intentional adjustments to your budget without throwing everything out. It's a way to get back on track without feeling like you're starting over from scratch.

If you've been feeling stuck, overwhelmed, or frustrated with your finances, this guide will help you reset your budget—without the stress.

Step 1: Identify What's Not Working (Without Judgment)

Before making any changes, you need to understand what's causing the problem.

Take a moment to look at your last three months of spending and ask yourself:

- Am I constantly overspending in certain categories?

- Do I feel restricted in areas that are important to me?

- Have I experienced income or expense changes that my budget hasn't adjusted to?

- Do I feel guilty or frustrated every time I check my bank account?

The Most Common Budgeting Issues & How to Fix Them

-

Overspending in Certain Categories

- If you consistently go over budget in groceries, dining out, or shopping, your budget might not reflect real-life spending patterns.

- Solution: Adjust these categories slightly to make them more realistic. If you keep going over on groceries, increase the budget and cut back somewhere else.

-

Feeling Too Restricted

- If your budget feels too tight, you're more likely to give up.

- Solution: Allow room for fun spending while cutting expenses that don't truly matter to you.

-

Unexpected Expenses Keep Derailing Your Budget

- If your budget gets wrecked by car repairs, medical bills, or gifts, you're missing a sinking fund.

- Solution: Set aside money each month for irregular expenses. Even a small sinking fund can make a huge difference.

Action Step: Look at your spending and pick one problem area to focus on first.

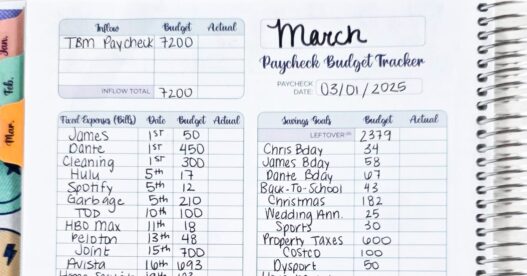

Step 2: Adjust Budget Categories That Aren't Working

Once you identify where your budget is breaking down, it's time to adjust your categories so they fit your actual spending.

How to Make Simple Budget Tweaks Without Starting Over

Increase Categories Where You Consistently Overspend

- Instead of forcing yourself into an unrealistic grocery budget, adjust it to better reflect your real spending habits.

Reduce or Eliminate Expenses That Don't Matter

- If you're paying for subscriptions you don't use, cancel them.

- If you're eating out often but don't actually enjoy it, reduce your restaurant budget.

Add a “Miscellaneous” Buffer to Reduce Stress

- Unexpected expenses happen. If your budget doesn't account for them, you'll always feel like you're failing.

- Adding a 5-10% miscellaneous category can prevent small unexpected costs from derailing your budget.

Action Step: Make at least one category adjustment today to align your budget with reality.

Step 3: Reconnect with Your Financial Goals (To Stay Motivated)

One of the biggest reasons budgets stop working is that we lose sight of our ‘why'.

If you've been feeling disconnected from your budget, take a moment to ask:

- What am I actually working toward?

- Is my budget helping me achieve that goal?

- Do I need to adjust my budget to make room for things that truly matter?

Examples of Motivating Financial Goals

- Building an emergency fund for peace of mind

- Saving for a dream vacation without using credit cards

- Paying off debt to free up money for long-term wealth

- Investing for the future so you don't have to stress about money later

Action Step: Write down your biggest financial goal and put it somewhere you'll see every day.

Step 4: Address Emotional Spending & Mindset Blocks

Budget resets aren't just about numbers—they're also about mindset.

If you've been emotionally spending or using money as a way to cope with stress, boredom, or comparison, it's important to recognize that habit.

How to Stop Emotional Spending While Resetting Your Budget

-

Identify Triggers

- Do you shop when you're stressed?

- Do you spend more when scrolling social media?

- Do you make impulse purchases when bored?

-

Find a Healthy Alternative

- Instead of shopping to feel better, try journaling, exercising, or calling a friend.

-

Create a 24-Hour Rule

- Before making any non-essential purchase, wait 24 hours. This helps curb impulse spending.

Action Step: Identify one spending trigger and commit to replacing it with a healthier habit.

Step 5: Implement a Daily Money Check-In (To Stay on Track)

Most budgets fail because people only check them at the end of the month.

Instead, set up a daily (or weekly) money check-in to stay on track before things go off course.

How to Do a Quick Daily Budget Reset

Step 1: Log into your bank accounts everyday. This doesn't only allow you to check in on your spending, but also check to ensure no fraudulent activities are happening in your account.

Step 2: Check your spending in each category—are you on track?

Step 3: Adjust for the upcoming day/week.

Action Step: Set a daily 5-minute budget check-in on your calendar.

Step 6: Track Your Progress & Celebrate Small Wins

The best way to make budgeting feel rewarding instead of restrictive is to track your wins.

Ways to Track Your Budget Progress

Create a Visual Tracker: Use a savings thermometer or debt payoff chart.

Celebrate Small Wins: Every time you stick to your budget, acknowledge it!

Action Step: Pick one way to track your progress and start today.

Final Thoughts: Your Budget Isn't Broken—It Just Needs a Reset

Budgeting isn't about perfection—it's about progress. If your budget isn't working, don't give up. Instead, adjust and move forward.

Recap of a Soft Budget Reset:

- Identify problem areas (without judgment).

- Adjust categories to match real-life spending.

- Reconnect with your financial goals.

- Address emotional spending triggers.

- Set up a weekly check-in to stay on track.

- Celebrate small wins to stay motivated.

You've got this! Reset, adjust, and keep moving forward.

Want More Budgeting Help?

Join my newsletter subscriber list to ensure you're first to know about new products, exclusive sales and announcements, and weekly insight from me. Sign up here!