Wealth is a strange beast. We chase it, measure it obsessively, compare it to everyone else's…yet rarely do we stop to ask what it actually means when we've crossed the finish line.

Over the past year, many Physician on FIRE articles resonated with our readers. Some touched a nerve, while the comment sections of others became places where physicians felt seen and perhaps even found solace in talking to their fellows.

Love it or hate it, wealth…or rather the pursuit of it, has a grip on us all. But it's good to know you're not alone.

This week's Throwback Thursday digs into the vault to revisit wealth from every angle: The bizarre mentality of never feeling rich despite crushing it by any objective measure, the wild moment when your money works harder than you do, the elusive question of “how much is enough,” and the money moves that separate the drifters from the deliberate in your peak earning decade.

The Data Says You Are Rich

High earners can sometimes fall into the trap of feeling perpetually broke despite being rich by literally every statistical measure.

If you're pulling in $200K as a household — congrats, you're in the global top 2%. The median American net worth sits at $192,000.

If you're sitting on multiples of that, you're objectively wealthy. Period. Full stop. But… the unfortunate reality is that Americans don't measure wealth by numbers. We measure it by where we can afford to summer, the uniform of our kids' private school and the year and make of our cars.

I think what resonated most with readers from this article was the income-versus-networth smackdown.

Income is the money rolling in; net worth is what you actually keep. A family clearing $350K with two mortgages can feel dead broke while someone grinding away at $90K who saves like a maniac can sneakily build a seven-figure war chest. Ultimately, I think we all felt some comfort from reading that it's okay to stop playing the comparison game and just track our own scorecard.

If we can all just quit asking “Am I rich?” and start asking “Am I building wealth?”I think we'd all be a little bit happier.

Read more: Are You Really Wealthy? A Data‑Driven Look at How High Earners Undervalue Their Net Worth

The Awkward Moment When Your Money Makes More Money Than You

To think an article about the magic of compounding could be so relatable.

When Your Portfolio Makes More Money Than You nails the moment you never saw coming — when your investment account out-earns your actual job. Mind. Blown.

Once your portfolio hits 10x your annual savings, it'll match or beat your work contributions roughly half the time. Get to 25x and your portfolio's basically lapping you in most years that aren't dumpster fires.

The calculus is dead simple: Take 100, divide it by your portfolio's return percentage, and boom, that's the multiple you need. In a good year with 25%+ returns? You only need 4x your annual savings to get shown up by your own money.

Most of you attested to the psychological gut-punch this creates. You're grinding through call nights and administrative nonsense, going the extra mile, and then you check your account to find your investments crushed your paycheck contribution without breaking a sweat.

One comment read: “This happened to me last year for the first time (and this year is shaping up to be the same.) It's a strange feeling when you see the figures – I was almost numb, because I didn't believe it could happen to me. Anyway, guess who's going part-time next year??!?”

Meanwhile, another pointed out the wild tax implications: “When your portfolio is earning dividends & interest in large quantities, your tax bill increases significantly… Today, my take-home pay is less than it was 25 years ago in nominal dollars. It's a strange situation. It's almost as if I can't afford to keep working.”

And The White Coat Investor himself lent some wise words. “I'm not even close. Never have been. For most, this point is well beyond FI and you really won't hit it until you retire or at least cut back severely. In fact, if you get there, it can be argued that you drastically oversaved and could have given more away, spent more, or retired earlier.”

The truth is, once you see that your portfolio's doing the heavy lifting, you can't unsee it. That's when the “just one more year” syndrome either takes over or finally gets put to bed.

Is There a Bowl of Wealth Goldilocks Would Call “Just Right”?

Nick Maggiulli's piece gave readers much needed permission to call it good and stop climbing. Spoiler alert: high achievers are terrible at this.

A family of four needs about $120K a year after taxes for a solid middle-class life. Want to walk away from work forever? You need $3.5M (that's 28.6x annual spending using the 3.5% safe withdrawal rate).

If you're going the Coast FIRE route by saving big now, and working just enough to cover bills later? That's $1M–$2M depending on how old you are. So…the sweet spot for “ideal” wealth in America lands somewhere between $2M–$5M.

For me, it was the honesty that massive wealth can actually screw you up that made the post really hit home. Felix Dennis was worth $750M when he wrote: “Becoming rich does not guarantee happiness.”

It's reassuring to be told that having a real target number that's enough but not ridiculous — where you stop sweating money but don't end up with so much it warps your personality or wrecks your relationships.

One commentor laid out his thoughts: “I think the ideal amount of wealth for a family of four in the USA is an income of 400K and a net worth of 5-10 mil with a career that is not overly demanding, about 30 hours per week and at least 6 weeks of vacation time yearly, in a region that is safe without overly crushing taxes and a good education system for the children as well as an abundance of natural beauty. More money than this creates more problems, less money than this is totally fine but not the ‘ideal.'”

The truth is, you don't have to squeeze every last dollar out of life. There's a number where more money doesn't actually make things better, and it's totally okay to plant your flag there and call it a day.

Read more: The Ideal Level of Wealth

Adulting in Your 40s: Mo' Money, Mo' Problems

Here's a post that became must-read material because it put words to the weird limbo physicians in their 40s find themselves in — making bank but feeling rudderless.

Your 40s are sneaky dangerous precisely because they feel stable. You're printing money but also hemorrhaging it faster than ever. An average physician should have 3–4x their annual income socked away by their mid-40s (north of $650K for most).

Unnervingly, 36% of American households pulling in over $200K still live paycheck-to-paycheck. So while the urgency of your 30s may have subsided…you have yet to figure out the endgame.

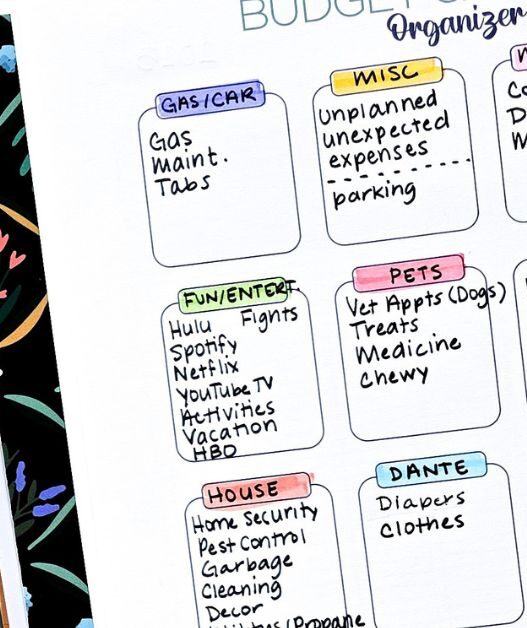

While there is no set-in-stone enchiridion out there on how to manage your finances, some moves will always hold true (no matter what the market is like).

Hire a fiduciary advisor (75% feel dialed in versus the 50% barely winging it alone), beef up your emergency fund to 6–12 months for the curveballs medicine (or the market) throws at you, hunt down lifestyle creep and kill it with prejudice, max out all the retirement vehicles including those fancy backdoor Roths, update your insurance game (term life should be 20x income), and have the awkward money talk with your aging parents.

Your 40s aren't the time to rack up fresh debt or cruise on autopilot. Make your moves deliberately or you'll sleepwalk right into a retirement you're not ready for.

Read More: Money Moves for Physicians in Their 40s

Real Returns on Real Estate

And finally, here's an ode to our Swiss Army knife resource page that keeps answering the same question: “How do I diversify without becoming a landlord who fixes toilets at midnight?”

The JOBS Act of 2012 blew the doors wide open for regular docs to throw money at the same institutional-grade real estate deals that used to be reserved for Yale's endowment and billionaire family offices.

Minimums run anywhere from $5K to $100K, depending on the deal. And the best part? The solid operators put at least 20% of their own cash in alongside yours. When they've got real skin in the game, everybody's incentives line up nice and tidy.

This landing page offers up a buffet of options hitting different goals. Trust deed deals throw 10–12% returns over 9–18 months with first-position collateral.

Commercial real estate platforms serving up debt, preferred equity, and straight equity plays across all kinds of property types.

Funds cranking out monthly income without you managing squat. Readers dug, and continue to dig having a one-stop-shop of vetted choices across the risk/return spectrum instead of the binary “buy index funds or become a landlord” broken record.

Real estate plugs the hole between stock market roller coasters and the headache of direct ownership. No one's suggesting that you ditch your stocks. But true diversification means building a portfolio that doesn't tank every time the S&P 500 catches a cold.

Read more: Passive Real Estate Investments for Physicians

You've Got This, Doc

I know I don't need to tell you this, but here's a reminder anyway: recognizing when you're winning, and knowing when to push back from the table, means that you can be wealthy without losing your mind in this cutthroat world where overconsumption has become the yardstick.

These articles have racked up thousands of views because they tackle the questions that actually matter to high earners stuck in the weird middle zone between “doing pretty good” and “I'm outta here.”

So where are you right now? Still in building mode? Wondering if you've already made it? Trying to figure out what the hell comes next?

Drop a comment and let us know where you are on this wild ride.