Let's be real: no matter how carefully we plan, budgets don't always go the way we expect.

You've done the work. You sat down, made your plan, maybe even color-coded it. And then life showed up with an unexpected vet bill, a flat tire, or a last-minute school fundraiser. Suddenly, your beautifully planned budget feels like a mess, and you might feel like you failed.

But here's the truth: a messy budget isn't a failed budget.

Your budget isn't supposed to be perfect; it's supposed to reflect your real life. And real life? It's unpredictable.

So if your budget didn't go as planned this month, you're not alone, and you're not doing it wrong. Here's what to do instead.

1. Take a Breath and Let Go of the Guilt

Before you do anything else, pause. Take a deep breath.

Blowing your budget doesn't make you bad with money. It doesn't mean you're irresponsible. It doesn't mean you've failed. It means you're human.

Life doesn't follow a script. Kids get sick. Cars break down. Sometimes we're just tired, and takeout wins. That doesn't make you a failure; it makes you real.

Guilt and shame can keep you stuck, but compassion creates clarity. So let go of the negative self-talk, and remind yourself that this is part of the process. You are learning, not failing.

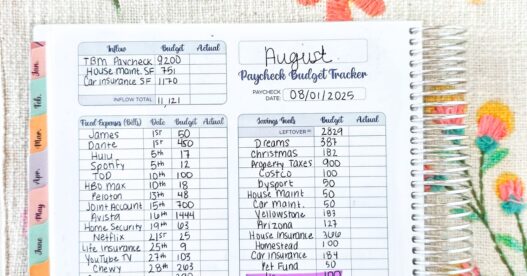

2. Look at the Numbers

When something doesn't go as planned, it's tempting to avoid your budget altogether. You might think, “I already blew it, so what's the point?”

But the most empowering thing you can do is face the numbers.

Open your budget. Look at what you planned and what actually happened. Don't beat yourself up. Just observe.

Ask yourself:

- Where did things go off track?

- Were the expenses truly unexpected, or just forgotten?

- Was the budget realistic to begin with?

This step is about gathering data, without judgment. It's like being a detective. The more information you have, the better decisions you can make moving forward.

Try using highlighters or color-coding to spot categories that consistently go over budget. Visual patterns can help you see what's really going on.

3. Adjust and Reallocate

Once you've reviewed the numbers, it's time to take action.

Budgeting isn't about being rigid. It's about staying responsive to real life. If something unexpected happened, you can adjust.

Ask yourself:

- Can I pull from a sinking fund or emergency savings to cover this?

- Can I shift money from non-essential categories (like eating out or subscriptions)?

- Can I pause a savings goal just for this month to create breathing room?

Let's say you went $150 over on groceries, but haven't touched your entertainment fund. That's a simple shift.

If you use a zero-based budget, reallocate the leftover funds from categories you didn't fully spend. Flexibility is key here.

And if you had to put an expense on a credit card? You're still not failing. You're adjusting. Create a plan to pay it off and stick to it.

4. Learn From the Month

Every budget “fail” is valuable feedback.

Instead of feeling bad, get curious:

- Did I forget to plan for something that happens often?

- Do I need to increase my budget in certain areas?

- Am I being realistic about my habits and lifestyle?

Maybe your gas budget is always off. Or you're constantly forgetting to plan for school events, pet needs, or seasonal expenses.

These aren't surprises—they're signals. Use them to start new sinking funds, increase category limits, or build in more flexibility.

Think of this as budgeting in layers: each month adds a new layer of understanding. That's how you create a budget that fits your life.

5. Make a Plan for Next Time

Now that you've learned from the last month, it's time to plan ahead.

This isn't about over-correcting. It's about tweaking your system so it supports you better.

Here are a few ideas:

- Add a “buffer” category to cover the unexpected.

- Start a mini emergency fund if you don't have one.

- Reassess your fixed vs. variable expenses—are they still accurate?

- Use your calendar to track upcoming events that impact spending.

You might also decide to shift to paycheck budgeting if monthly doesn't feel manageable. Or maybe you need a visual tool, like cash envelopes or a printable planner.

Give yourself permission to try something new.

6. Celebrate What Did Go Right

In all the stress of a budget gone sideways, we often forget to notice the wins.

So ask yourself:

- Did I pay my bills on time?

- Did I track my spending more than last month?

- Did I say no to something that used to be an automatic yes?

Progress isn't always loud. Sometimes it looks like small, quiet choices that align with your values. Celebrate those. They matter.

If you saved even $5 or avoided one impulse buy, that's a win.

7. Know That You're Not Alone

Every single person who budgets goes through this. I've had plenty of months where things didn't go according to plan.

This doesn't make you bad with money. It makes you normal.

That's why it's so important to build a system that works with your life, not against it. Budgeting isn't about restriction. It's about clarity, confidence, and peace of mind.

8. Create a System That Supports You

If you're constantly feeling like your budget isn't working, it may be time to revisit your approach.

Here are a few tools that can help:

- Sinking funds: These are powerful for handling irregular expenses.

- Highlighter method: Helps you categorize past spending and see habits clearly.

- Budget calendar: Keeps your month organized so you never forget what's coming.

- Cash envelopes (or cashless versions): Great for spending boundaries.

- Separate savings accounts: Makes tracking goals easier and helps you stay on target.

You don't have to do all of these. Pick one or two and see how it feels. Build from there.

The goal is to build a system you can stick with because it reflects the way you actually live.

Final Thoughts

At The Budget Mom, I always say this: your budget should reflect your real life—not some picture-perfect version of it.

And in real life, things come up. We adjust. We learn. We keep going.

So if this month didn't go as planned, you don't need to start over. You don't need to shame yourself. You just need to pivot with intention.

You're not failing. You're growing.

And that? That's what real financial progress looks like.