You've followed all the rules.

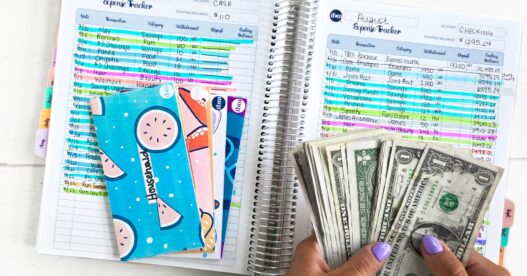

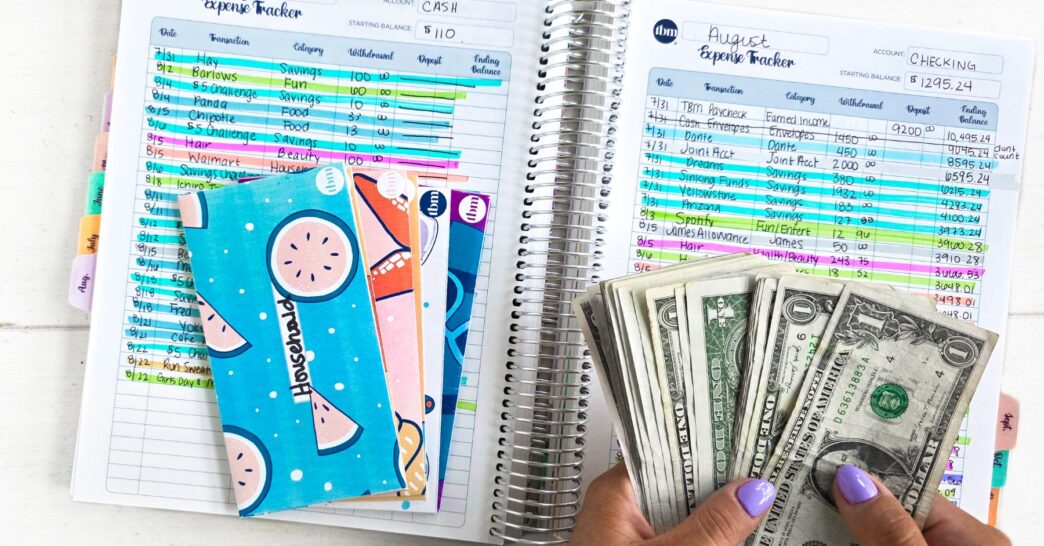

You've downloaded the spreadsheets, tracked your spending, color-coded your categories, and set your savings goals.

You're showing up, paycheck after paycheck. You've said no to dinners out, resisted Target impulse buys, and used cash envelopes like a pro.

And yet—it still feels hard.

Sound familiar?

If you've ever found yourself thinking, “Why is this still so difficult when I'm doing everything I'm supposed to be doing?”, you're not alone. The truth is, budgeting isn't just about the numbers. It's not just a math equation you solve once and then coast on forever. It's emotional. It's layered. And it's deeply human.

This article is your permission slip to explore why budgeting can feel hard—even when you're doing everything “right”—and what you can do to shift your perspective, reconnect with your why, and build a system that works for your real life.

1. You're Emotionally Tired, Not Financially Failing

Let's start here: budgeting fatigue is real. You may not be financially failing—you might just be emotionally exhausted.

Budgeting requires ongoing decision-making, sacrifice, and discipline. It asks you to stay constantly aware of your habits and money behaviors. It demands attention in a world that's already pulling you in a hundred directions.

And if you're a giver, a mom, a business owner, a caregiver, or just someone holding a lot—it's not that you're bad with money. You're simply tired.

The Mental Load of Budgeting

Just like the invisible labor of parenting or running a household, there's an invisible labor to managing your money:

-

Constantly thinking ahead to the next bill

-

Remembering due dates

-

Strategizing how to stretch a tight paycheck

-

Figuring out how to say “no” again—to your kid, your partner, yourself

You're not just juggling a budget—you're juggling life. And life is unpredictable. So give yourself some credit. You're not failing. You're carrying more than most people can see.

2. Budgeting Feels Like Deprivation Instead of Freedom

Another reason budgeting feels hard is that, for many people, it feels like a punishment.

Maybe you grew up watching money being mishandled—or maybe you grew up without much of it at all. Maybe budgeting entered your life because things were already tough—because you were drowning in debt or barely making ends meet. So now, budgeting feels tied to restriction, to survival, to anxiety.

But budgeting was never meant to be a form of punishment. It's a tool for awareness, empowerment, and freedom.

Shifting the Narrative

If budgeting feels like deprivation, ask yourself:

-

Am I leaving room in my budget for joy?

-

Do I have even a small “fun” or “flexible” category that allows me to breathe?

-

Am I tracking out of fear or out of curiosity and intention?

The way we emotionally frame our budget changes everything. Instead of saying:

“I can't afford that,” try:

“It's not a priority for me right now.”

That subtle change removes shame and replaces it with power.

3. Your Budget Isn't Aligned With Your Real Life

A budget that doesn't reflect your actual life will always feel hard.

A lot of people create budgets based on what they wish they spent or what a template says they should spend. But life doesn't follow templates. And budgeting isn't about performing for a spreadsheet—it's about planning for your real-world priorities, values, and habits.

Common Misalignments

-

Budgeting $150/month for groceries when you regularly spend $500 and have never once hit $150

-

Leaving out irregular but predictable expenses like car maintenance or school supplies

-

Setting unrealistic goals for savings or debt payoff because “that's what I should be doing”

If your budget is constantly setting you up to fail, it's time to stop asking, “How do I fix myself to fit this budget?” and start asking, “How do I build a budget that fits my real life?”

4. You're Experiencing Budget Burnout

If you've been budgeting for a long time, especially during a difficult season, burnout can creep in.

Even if you've made progress, the emotional toll can build up:

-

The mental fatigue of constantly cutting back

-

The resentment from always having to say no

-

The disconnection from your original “why”

You might start wondering: Is this it? Am I just supposed to restrict forever?

Recognizing the Signs of Burnout

-

You feel dread opening your budget or checking your bank account

-

You abandon your budget after one “off” week

-

You're sticking to the plan but feel no sense of progress or joy

If this is you, it's time to re-engage your sense of purpose. Go back to the beginning. Why did you start this journey in the first place? What are you working toward? Sometimes, the best thing you can do is pause, reset, and reconnect with your why.

5. You're Not Accounting for Life's Curveballs

One of the biggest reasons budgeting feels hard is because life is unpredictable—but many budgets assume it's not.

Flat tires. Vet bills. Sick days. Travel for a funeral. Sports uniforms. Teacher gifts. A friend's baby shower. These aren't emergencies, but they're also not monthly line items. And when they're not accounted for, they can throw your entire system into chaos.

This is where sinking funds become your budget's best friend.

What Are Sinking Funds?

Sinking funds are mini savings buckets for irregular but expected expenses. You set aside a little each month so you're not caught off guard when life happens.

Examples:

-

Holidays

-

Birthdays

-

Car repairs

-

School activities

-

Vet visits

-

Clothing

The more you build these into your budget, the more you reduce the “budget busters” that make things feel hard and chaotic.

6. You're Expecting Perfection

Let's be real: budgeting on paper always looks cleaner than budgeting in real life.

But when you expect yourself to stick perfectly to a set of categories without ever needing to adjust, pivot, or borrow from another envelope—you're setting yourself up to feel like a failure.

Progress is not perfection. A “good” budgeter is not someone who never goes over. A good budgeter is someone who stays engaged, learns from patterns, and adjusts as needed.

Budgeting Isn't a Test

You don't “pass” or “fail” each month.

Even if you go over, miss a goal, or forget to track, you're learning. And that's the whole point. Budgeting isn't about getting it right every time. It's about getting real every time.

7. You Haven't Made It Personal Enough

A budget that isn't built around your values, priorities, and long-term goals will always feel like someone else's plan.

Are you budgeting in a way that reflects your life? Your dreams? Or are you trying to follow someone else's rules?

Your system has to feel like yours.

Ask Yourself:

-

What do I value most right now?

-

What makes me feel alive, joyful, fulfilled?

-

How can I make space for that in my budget?

Whether that's saving for a solo trip, buying art supplies, investing in your business, or taking your kids on weekly donut dates—your budget should make space for you.

Because if your budget doesn't reflect your life, it will always feel like a burden instead of a tool.

8. You're Not Celebrating the Small Wins

It's easy to focus only on the big milestones: paying off a credit card, saving your first $1,000, hitting your debt-free scream moment.

But the day-to-day small wins matter even more—because they're the ones that add up to transformation.

Did you:

-

Track your spending this week?

-

Say no to an impulse buy?

-

Meal plan with what you had at home?

-

Avoid dipping into a sinking fund?

-

Stick to your food budget for the first time this month?

Celebrate that.

Those small moments are the bricks your foundation is built on. Without them, the big wins don't happen. And the more you acknowledge and reward yourself for those small moments, the more motivated you'll feel to keep going.

9. You're Doing It Alone

Budgeting can feel isolating, especially if your partner isn't on board, your friends spend differently, or your family doesn't understand.

It can feel like you're carrying the entire financial plan for your household. Like you're the only one thinking about bills, groceries, goals, and what's left in the checking account.

That emotional load? It's heavy. And it's often invisible.

You Don't Have to Do This Alone

-

Join a community of people who get it

-

Listen to podcasts that normalize the ups and downs

-

Share your journey (even if it's messy)

-

Talk to a partner about the invisible work you're doing

Budgeting is already hard. Doing it without support makes it even harder.

10. You've Outgrown Your Budgeting System

Here's something no one tells you: the system that got you started might not be the system that gets you to the finish line.

You grow. Your life evolves. Your goals change. Your income shifts.

And sometimes budgeting feels hard simply because the tools you're using are outdated for the life you're living now.

If you started with a bare-bones budget but now need more flexibility, adjust.

If you used to use cash envelopes for everything but now want to track more digitally, adjust.

If your old system felt good when you were paying off debt, but now you're focusing on wealth building, adjust.

Budgeting is not a one-size-fits-all journey. It's allowed to evolve.

Bottom Line

Budgeting isn't a punishment. It's not a test. It's not a trend.

It's a personal tool to help you live your most aligned life—on your terms.

Yes, it's going to feel hard sometimes. But that doesn't mean you're doing it wrong.

It means you're showing up for your life in a very intentional way. You're facing reality with courage. You're planning for your future. You're learning about yourself.

And that is brave work.

So the next time budgeting feels hard, pause and ask:

-

Am I emotionally tired?

-

Is my system still working for me?

-

Have I left room for joy?

-

Am I being honest about my life—or trying to make it fit into a perfect plan?

Give yourself grace.

You're doing better than you think.