For a long time, the idea of “financial freedom” felt like the ultimate goal. It was the phrase I saw everywhere. It was what everyone was working toward. The books, the experts, the blogs, the influencers—they all promised that financial freedom would be the key to happiness. To peace. To living a life on your terms.

And for a while, I believed it.

I believed that if I could just become debt-free, or save a certain amount of money, or buy a home outright, or hit some magical number in my investment accounts, that I would finally feel free. But the more I achieved, the more I realized that something was missing. I was doing the things the world told me would bring freedom, but I didn't feel free.

What I felt was burnt out. Anxious. And still stuck.

The truth is, I don't believe in financial freedom anymore. At least not the way it's sold to us. Because what many of us are actually chasing isn't freedom—it's fulfillment. And the path to fulfillment looks a whole lot different.

The Problem With “Financial Freedom”

The phrase “financial freedom” sounds beautiful. Who wouldn't want to be free from worry, free from stress, free from the burden of bills or debt or work? But here's the issue: it's vague. It's undefined. And most importantly, it's deeply tied to unrealistic expectations that make us feel like we're failing.

For some people, financial freedom means retiring early. For others, it means quitting their job, moving to a beach, and living off passive income. But what about the mom working three jobs to keep her kids fed? Or the family paying off medical debt from a health crisis? What about the person healing from trauma who can barely function through the day, let alone optimize their investment portfolio?

The mainstream narrative around financial freedom assumes you have margin when it comes to time, energy, options, and support. But most of us don't start with those things. Many of us are fighting just to get back to zero. So when financial freedom is held up as the only end goal, it can feel like an impossible standard.

And here's what I've learned: chasing a finish line that keeps moving doesn't bring peace. It brings pressure. It fuels comparison, hustle culture, and the illusion that you have to do more, be more, and earn more just to “arrive.”

We get so focused on future milestones that we disconnect from the present moment. We deny ourselves the joy of small wins. We delay happiness until some distant goal is reached. And often, when we finally get there, it still doesn't feel like enough.

Because we never defined what “enough” actually is.

What I Work Toward Instead: Financial Fulfillment

Fulfillment is different. It's not a destination. It's a feeling. It's a sense of peace and alignment with your values. It's knowing you're on a path that makes sense for you, not one you're forcing yourself down because someone online said it was the way.

Financial fulfillment is made up of three things: stability, clarity, and confidence. And you can experience those things at any point in your journey. Even if you're still paying off debt. Even if you're not investing yet. Even if you're just learning how to budget for the first time.

It honors your current life season. It meets you where you are. It doesn't shame you for not being further along.

1. Stability

Stability means your basic needs are met. It means you're not in constant survival mode. It doesn't mean you have millions in the bank. It means your inflow and outflow are balanced, and you have a plan. It's the moment you realize you can pay your bills, feed your family, and know what's coming next.

When I was a single mom living on $30,000 a year, stability didn't mean financial freedom. It meant:

- Being able to buy diapers without swiping a credit card

- Packing a lunch instead of skipping a meal

- Knowing I had $40 in cash for gas until payday

Stability isn't flashy. But it's transformational. When your nervous system isn't constantly triggered by financial fear, you start showing up differently in every area of your life. You parent better. You sleep better. You think more clearly. You start healing.

Stability gives you your life back. And that, to me, is far more powerful than “freedom.”

2. Clarity

Clarity is understanding your numbers and what they mean to you. It's knowing where your money is going, why it's going there, and whether it aligns with your values. It's not just tracking every cent, it's being intentional with every cent.

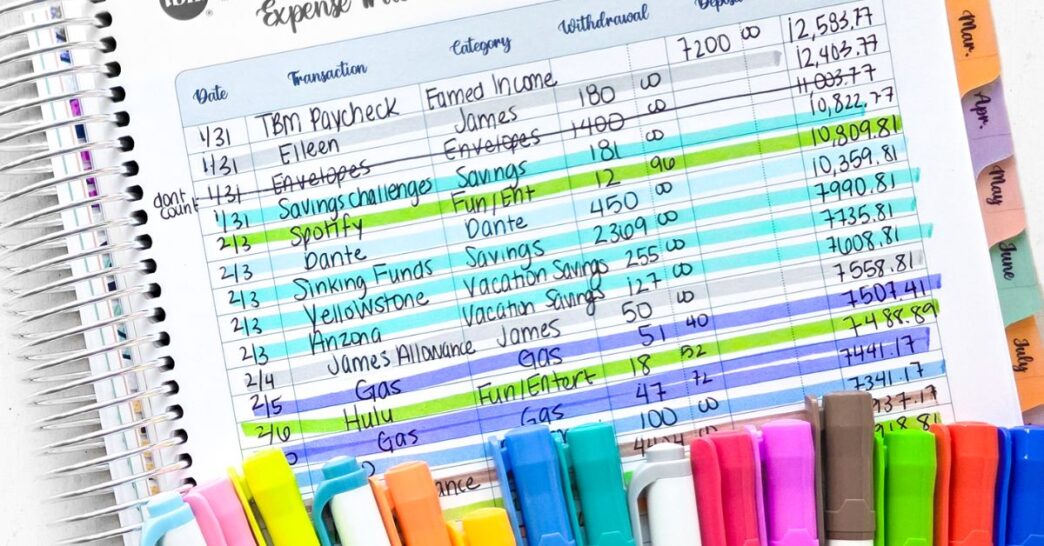

For me, clarity came through my Budget by Paycheck Method. It wasn't just about writing numbers on paper. It was about:

- Noticing when I was spending emotionally after a stressful day

- Realizing I was saying “yes” to too many financial obligations out of guilt

- Seeing how my goals weren't aligned with my actual spending habits

Clarity forces you to confront the truth, and that can be uncomfortable. But it's also where growth begins. Because when you see the patterns, you can change them. When you know your numbers, you take back your power.

It also helps you find your version of “rich.” Maybe rich to you is having Fridays off. Maybe it's being able to fund a sinking fund for a once-in-a-lifetime trip. Maybe it's knowing your rent is paid and there's food in the fridge. Clarity makes space for personal definitions of success.

3. Confidence

Confidence is built over time, through small wins. It's not about knowing everything. It's about trusting yourself. It's being able to say, “I know how to make a plan for my money that works for me.” It's not relying on external validation or constantly comparing yourself to others.

I remember the first time I walked past a sale and didn't feel the urge to buy. Not because I didn't want the thing, but because I knew I had other priorities. That moment meant more to me than hitting any net worth milestone. Because it showed me I had changed.

Confidence is saying no to things that don't align with your values. It's asking questions without shame. It's making decisions from a place of calm, not panic.

Letting Go of the Illusion

I want to be honest: this shift didn't happen overnight. I had to let go of the image of success I had built in my mind. The one with the perfect house, the fully funded retirement accounts, the endless travel, and the financial “independence” that made life effortless.

But life is never effortless. Even with money.

No amount of money will eliminate discomfort. It won't fix your relationships. It won't heal your past. It won't give you meaning. It may offer options, but fulfillment is still something you have to choose. You still have to create it.

And sometimes the constant pursuit of more is what gets in the way of actually living.

When I let go of chasing financial freedom, I started:

- Budgeting with joy, not resentment

- Making space for hobbies, like baking sourdough and gardening

- Saying no to online pressure to hustle harder

- Choosing slower, simpler, more peaceful days

Letting go of financial freedom let me reclaim my life.

Redefining Success

Success, to me, is not retiring by 40 or earning six figures a month. It's:

- Waking up without financial dread

- Feeling safe, seen, and supported in your own life

- Being able to give to others without compromising your needs

- Teaching your kids about money with confidence

- Taking a nap without guilt

These are things no dollar amount guarantees. But they're also things you can cultivate as you go.

Redefining success is one of the most powerful steps you can take on your financial journey. Because it shifts the entire framework. It stops being about reaching some far-off goal and starts being about building a life you actually want to live.

How You Can Start Today

If you're reading this and feeling overwhelmed or behind, I want you to know this: you are not behind. You are right on time. Your journey is unfolding exactly as it should.

Here are some ways you can begin shifting from chasing freedom to cultivating fulfillment:

- Define your values: What truly matters to you? Not what you think should matter. What actually lights you up?

- Revisit your budget with intention: Does your spending reflect your values? Are there areas that feel out of alignment?

- Celebrate your small wins: Every debt payment, every mindful purchase, every moment of clarity is worth honoring.

- Unfollow the noise: If certain accounts make you feel inadequate or panicked, mute them. Create a healthier digital space.

- Start where you are: You don't need to wait to be debt-free, or have a high income, or be perfect. Fulfillment is available now, in the small, steady steps.

Final Thoughts

I used to think I wanted financial freedom. What I really wanted was peace. Security. The ability to make choices without fear. The power to create a life I loved.

Now I know that doesn't come from a finish line. It comes from the way I live today. The values I uphold. The decisions I make. The grace I extend to myself in hard moments, and the gratitude I feel in quiet ones.

If you feel like the promises of financial freedom haven't delivered, maybe it's time to let go of that vision. Maybe what you really need isn't more money, but a deeper connection to your values, your goals, and your worth.

Because freedom isn't the end goal. Fulfillment is. And that's a journey worth taking.