There's a belief most people carry quietly.

They don't always say it out loud, but it shows up in how they plan, spend, and postpone decisions.

“I'll get better with money when I make more.”

It sounds reasonable. Logical, even. If money stress is the problem, then more money must be the solution. And yet, year after year, we see the same pattern play out. Raises come and go. Bonuses hit accounts and disappear. Side income grows, but the anxiety doesn't shrink. And in extreme cases, people win the lottery and still end up broke.

This isn't because people are irresponsible, lazy, or incapable of managing money. It's because money habits are not income dependent. They are behavior dependent. And behavior doesn't magically change when the number on your paycheck does.

More money amplifies whatever habits already exist.

If you don't have systems, boundaries, and self trust in place, more money doesn't create stability. It creates more chaos with higher stakes.

Let's talk about why that happens, and more importantly, what actually works.

The Myth That More Money Equals Financial Stability

At some point in almost every financial journey, there's a moment when income feels like the missing piece. Maybe it's when bills feel tight. Maybe it's when saving feels impossible. Or maybe it's when you're doing “everything right” but still feel like you're barely keeping up.

So you tell yourself: once I earn more, this will get easier.

Sometimes income truly is the issue. No system can out budget a situation where someone simply does not make enough to cover basic needs. That reality matters and deserves to be acknowledged.

But for many people, especially those who do see income increase over time, the problem doesn't disappear. It just shifts.

More money doesn't remove financial stress if:

• Spending grows at the same pace as income

• There is no structure for where money goes

• Emotional spending patterns remain unchecked

• There's no clarity around priorities

• Money is used to regulate emotions or self worth

In fact, higher income can make these issues worse because the consequences are delayed. You can make bigger mistakes before feeling the impact. You can stay unaware longer. And by the time the stress hits, the numbers are larger and harder to unwind.

This is why someone earning $40,000 can feel more financially secure than someone earning $140,000. It isn't about the amount. It's about the relationship.

Why Bad Money Habits Follow You Into Higher Income

Money habits don't exist in isolation. They are shaped by experiences, beliefs, trauma, and patterns that often form long before someone earns their first paycheck.

If money was unpredictable growing up, you might spend quickly when it shows up because it feels temporary.

If money was used as a reward, you might associate spending with comfort or relief.

If money was a source of shame, you might avoid looking at it altogether.

If money felt like proof of worth, you might spend to keep up appearances.

These patterns don't disappear with a raise. They simply get more room to operate.

This is why people who receive sudden income windfalls often struggle the most. Without systems, more money feels overwhelming rather than empowering. Decisions feel heavier. Pressure increases. And spending can become reactive instead of intentional.

Money doesn't change who we are. It reveals it.

The Raise That Didn't Fix Anything

One of the most common stories people share is this:

“I finally got a raise, and somehow I still feel just as stressed.”

What usually happens is subtle. Expenses expand quietly. Maybe the car gets upgraded. Subscriptions creep in. Eating out feels more justified. Travel becomes more frequent. None of these choices are inherently bad. The issue is that they often happen without intention.

Lifestyle inflation isn't about enjoying your money. It's about money being consumed automatically instead of directed consciously.

When income increases but habits stay the same, there's no surplus to show for it. And when there's no surplus, there's no sense of safety. Which leads to the same stress that existed before, just at a higher income level.

Why Lottery Winners Are the Extreme Example

Lottery winners are often cited because they represent the most dramatic version of this problem. Someone goes from financial limitation to instant abundance, and within a few years, many are worse off than before.

This isn't because they didn't deserve the money. It's because money without structure is unstable.

When someone has never practiced managing money intentionally, a large influx creates pressure, not freedom. Everyone wants something. Decisions feel urgent. Emotions run high. And without boundaries or systems, spending becomes reactionary.

While most people won't win the lottery, the same dynamics apply on a smaller scale when someone receives a bonus, inheritance, tax refund, or sudden income growth.

If you can't manage $1,000 intentionally, managing $10,000 will feel chaotic. If you don't have a plan for $5,000, $50,000 will not feel empowering. The amount changes. The experience doesn't.

The Real Problem Isn't Income. It's Lack of Systems.

People often confuse discipline with systems. They believe financial success comes from willpower, restriction, or being “good” with money.

In reality, discipline burns out quickly. Systems create consistency.

A system answers questions before emotions get involved.

Where does money go when it comes in

What gets paid first

What gets saved automatically

What can be spent without guilt

What is off limits

Without these answers, every spending decision becomes a debate. And the more money involved, the louder that debate becomes.

This is why budgeting alone doesn't fix the issue for many people. A budget without structure and follow through is just a document. A system is something you return to repeatedly, even when motivation is low.

Emotional Spending Doesn't Disappear With More Money

One of the biggest misconceptions is that emotional spending is a “broke person problem.” It isn't. Emotional spending happens at every income level.

The difference is how visible it is.

At lower income levels, emotional spending causes immediate consequences. At higher income levels, it hides longer. But it still shows up in the form of:

• Shopping as stress relief

• Spending to cope with exhaustion

• Using money to feel in control

• Buying to avoid uncomfortable emotions

• Spending to match an identity or image

If spending is used as emotional regulation, more money simply gives it more fuel.

Until the emotional pattern is addressed, income changes won't change the outcome.

The Role of Self Trust in Financial Stability

One of the most overlooked parts of money management is self trust.

People who struggle financially often don't trust themselves with money. They believe that if they loosen control, everything will fall apart. This leads to extremes: either hyper restriction or complete avoidance.

Self trust is built through small, repeated actions that prove to yourself that you can follow through. Not through perfection. Not through rigid rules. But through consistency.

When someone trusts themselves:

• They don't panic spend

• They don't avoid looking at numbers

• They don't rely on motivation

• They make calmer decisions

More money without self trust feels dangerous. With self trust, even modest income can feel stable.

What Actually Changes Financial Outcomes

If more money doesn't fix bad money habits, what does?

The answer isn't exciting, but it is effective.

1. Awareness Without Shame

You cannot change what you refuse to look at. And you cannot sustain change if every look is followed by guilt or criticism.

Awareness means understanding:

• Where money actually goes

• What triggers spending

• Which categories cause stress

• What you consistently avoid

This isn't about judgment. It's about information. Data tells the truth. And truth is what allows change.

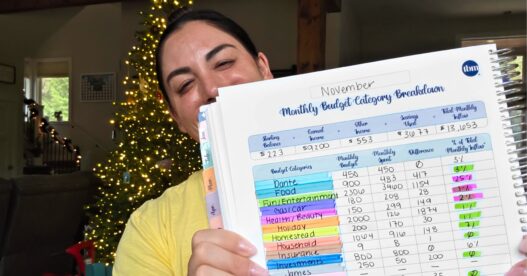

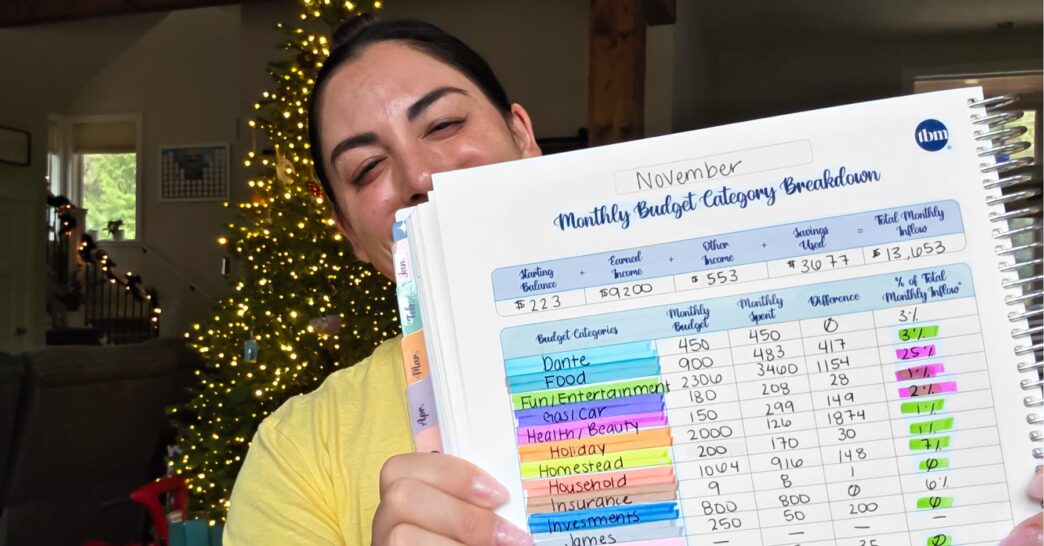

2. Systems That Run Even When Life Is Messy

Life does not operate on perfect months. Motivation fluctuates. Energy dips. Unexpected expenses happen.

A good system accounts for this.

Automatic savings. Sinking funds. Clear categories. Simple tracking. These reduce decision fatigue and emotional spending. They don't rely on you feeling disciplined. They work when you're tired.

3. Clear Priorities, Not Vague Goals

Many people say they want to “be better with money.” That isn't a priority. It's a wish.

Clarity means knowing:

• What matters right now

• What can wait

• What is worth spending on

• What is not

When priorities are clear, spending decisions become easier. Guilt decreases because money is aligned with values, not impulse.

4. Addressing the Emotional Side of Money

This is the part most financial advice skips.

Money is emotional. Pretending it isn't doesn't make it rational. It makes it reactive.

Understanding why you spend, avoid, or obsess over money matters more than any spreadsheet. When emotional patterns are acknowledged, behavior becomes easier to change.

5. Consistency Over Perfection

Financial stability is not built in big moments. It's built in ordinary ones.

Paying attention regularly. Adjusting as needed. Returning to the system after mistakes. Progress comes from repetition, not from flawless execution.

Why Waiting to “Make More” Keeps People Stuck

When someone believes money habits will fix themselves later, they delay the very work that would make more money feel safe.

Waiting creates a false starting line. And the longer someone waits, the harder it feels to begin.

The truth is this:

If you can manage money intentionally now, future income becomes a tool.

If you can't, future income becomes a burden.

You don't need more money to build good habits. You need habits to handle more money.

The Quiet Confidence That Comes From Doing the Work

People who develop healthy money systems don't feel superior. They feel calmer.

They know what's coming. They know where their money is going. They know how to adjust when life changes. They don't panic when income fluctuates or expenses pop up.

That confidence doesn't come from income. It comes from practice.

And the best part is that once the foundation is built, income increases actually feel good. They don't disappear. They don't create anxiety. They enhance what already works.

Bottom Line

More money can open doors. It can create options. It can relieve real pressure. But it does not heal financial patterns on its own.

Money doesn't fix habits. People do.

The work happens before the raise, not after it. Before the windfall. Before the “someday.”

And the people who do that work don't just end up with more money. They end up with more peace.